The Pension Solution of the Future

We have crafted a unique pension solution that addresses your key challenges and allows you to stay innovative and agile – offering a completely new approach to managing pensions for the industry in Denmark and Europe.

The solution consists of an integrated suite of battle-tested platforms covering all aspects of pension from communication to case management and final payout. Common among them is that they are easily scalable, rapidly deployable, battle-tested, modular – and perfectly integrated to create a coherent, fluid workflow.

Integrated, they will keep you competitive in a pension landscape of tough competition and increasing pressure to create new solutions.

Mit.dk

Netcompany’s communications platform brings you all the way from member to core and lets your members perform extensive self-service.

AMPLIO

Netcompany’s administrative and battle-tested platform ensures a high degree of automatisation and visibility in case handling.

EASLEY AI

Netcompany’s virtual assistant is your intelligent pension partner that automates processes such as data entries and assists you in making sense of and reviewing extensive documentation.

Life & Pension

Festina Finance’s platform is built by pension experts, supports every conceivable kind of pension and insurance product, and offers 100 % straight-through processing with full retroactive change for all business processes.

Customer reference

Customer reference

Forca and Netcompany sets out to innovate the pension landscape

Netcompany and the pension alliance Forca have partnered in a groundbreaking effort to innovate how pension companies best manage the Danes’ pension savings. Replacing over half of Forca’s existing system landscape, the pension solution will support digital services, processes, and the digital experience for both the customers and their members.

- »Our partnership with Netcompany marks a significant step forward, paving the way for a far more modern approach to managing members’ pensions. Moving Forca to a market-leading technological platform will lower our costs and free up more resources to focus on our primary mission – creating value for the members.«

Søren Østergaard, CEO of Forca.

Identified Challenges

Increasing complexity and flexibility demands

Pensions are complex financial products subject to extensive and ongoing legislation, such as the introduction of IORP II Directive (Institutions for Occupational Retirement Provision). Secondly, the pension industry is fast-moving, which pushes companies to create new offers and products. In this world, you have to maintain business agility by being able to adapt to new business developments and legislation – all the while ensuring compliance, and without having to include a new supplier every time a new need arises.

Difficulty getting from Customer to Core

Business processes in pension companies are often fragmented across various systems today or are handled manually. Total process support from customer to core, where, for example, the pension advisor can process cases, retrieve customer data, and ensure that policy information is updated, all in the same flow, is rare. Managing customer data integration into backend systems is vital for GDPR compliance, service continuity, and improved satisfaction, while safeguarding privacy throughout the customer journey remains a critical priority.

A lack of efficient case management

Commonly, pension advisors face fragmented workflows, such as creating pension scheme offers and processing payments across multiple systems, demanding significant manual effort. For instance, if the Core and Case Management systems are not well integrated, any transition between them becomes inefficient and labor-intensive.

A lack of overview

Today, pension advisors often lack sufficient data and documentation from the member to the case assessment, meaning that pension advisors spend a lot of time obtaining and following up on necessary data. A complete, up-to-date overview is lacking. This makes it hard to manage, distribute, and prioritise cases and to make resource planning, thereby complicating business progress and compliance.

Our solution

In 2023, we partnered with Festina Finance to create a next-level solution and a new standard for the pension industry. The standardised solutions of Festina Finance and Netcompany work together seamlessly to create a stack for the pensions area with standard pensions processes, integrations, and communication channels.

»With the partnership, we can focus on what we do best—developing software solutions—while Netcompany does what they do best—implementing complex and business-critical IT solutions«

Morten Schantz, Founder of Festina Finance

AMPLIO Benefits

360° Member Overview in AMPLIO

AMPLIO offers a 360° overview of members, storing and displaying basic data in a GDPR-compliant environment, tailored to highlight pension-relevant information. When a member profile is opened, it is locked to prevent erroneous edits by other system users. Data includes entries from the CPR registry and policy information from Festina Finances core, supported by fast and seamless navigation with shortcut keys.

Smooth case management

AMPLIO handles all pension processes from start to finish, encompassing both automatic and manual management. It ensures full traceability and audit trails, provides an easy overview of all cases, including KPI measurements and task assignments, allows for the postponement of cases, and facilitates the addition of various forms of documentation. Integration with industry-specific data sources enhances functionality.

Complete case control

AMPLIO provides a complete overview of all cases, highlighting overdue cases and automatically assigning them to advisors. It features intuitive lists and dashboards for a total case overview, displays real-time KPIs, generates reports, and notifies users of cases nearing deadlines. It also allows advisors to view their current cases, those pending response, and recent member interactions.

Integrated communication and correspondence

With AMPLIO, all communication is designed without supplier involvement and can be sent through multiple channels such as mit.dk Digital Post. The system uses familiar tools like Microsoft Word for designing letters and communications, and integrates these communications directly with case management for efficient tracking and response.

Secure archiving

AMPLIO ensures secure and GDPR-compliant archiving of all data and communications, maintaining full traceability in GDPR-secure databases and file storage systems. It supports quick searches across customers, products, and policies and allows for the configuration of metadata and retention policies.

High configurability

The system offers a high degree of configurability to reduce supplier involvement, allowing adjustments in products, policies, and case management to ensure solution ownership. AMPLIO’s rich administration module, which can be rights-managed, allows users to configure everything from texts and values to case KPIs, ensuring a flexible and responsive user experience.

Mit.dk benefits

Collect health information

Mit.dk allows case managers to collect health information from a member directly through mit.dk using the Connect feature, ensuring easy digital retrieval of sensitive information and data.

White-label solution

Advanced mit.dk features can be used seamlessly within your existing CMS, ensuring users can continue using your well-known interface.

Obtain contact information and consent

Retrieve updated contact information from members and digital consent easily and seamlessly through mit.dk.

Easy digital voluntary pensions contributions

Want to pay into your pension voluntarily? Mit.dk facilitates simple and straightforward voluntary payments by members digitally.

Communicate in a GDPR-secure environment

All sensitive personal information is sent and stored under secure conditions on mit.dk, ensuring you and your members’ personal information and confidential data are well protected.

Easley AI Benefits

Validate and assess documents

EASLEY AI streamlines the validation and assessment of document content, such as customer submissions. By automatically identifying deficiencies and summarizing content it expedites case processing, ensuring faster and more efficient handling.

Speed up case processing

EASLEY AI supports pension advisors by assessing cases and decisions, significantly speeding up case processing. This provides valuable assistance, enabling quicker and more informed decision-making in pension advising.

Create text with AI

Easley AI can be employed as a writing-assistant for specific documentation and record-keeping purposes, addressing deficiencies to enhance the speed and efficiency of case processing. This facilitates precise and timely documentation across various administrative tasks.

Assisted with self-service

EASLEY AI elevates customer service tasks and reduces operational costs. Automating interactions improves service efficiency and helps manage customer inquiries with minimal human intervention.

Advisor support

AI advisory support enhances personalised pension counselling and customer experiences. By leveraging artificial intelligence, advisors can offer tailored advice that aligns more closely with individual client needs, improving the advisory process and customer satisfaction.

Festina Finance's Life & Pension Platform Benefits

Covers all types of pension products and policies

The Life and Pension platform covers all kinds of life and pension products and policies – no exclusions.

Fully scalable

Festina’s solution is scalable from simple individual policies to full employer group pension plans.

100% STP

Enjoy 100% straight-through processing with full retroactive change for all business processes.

Fully configurable

The solution is designed to be fully configurable and adaptable, allowing users to tailor its features and functionalities to meet specific needs and preferences.

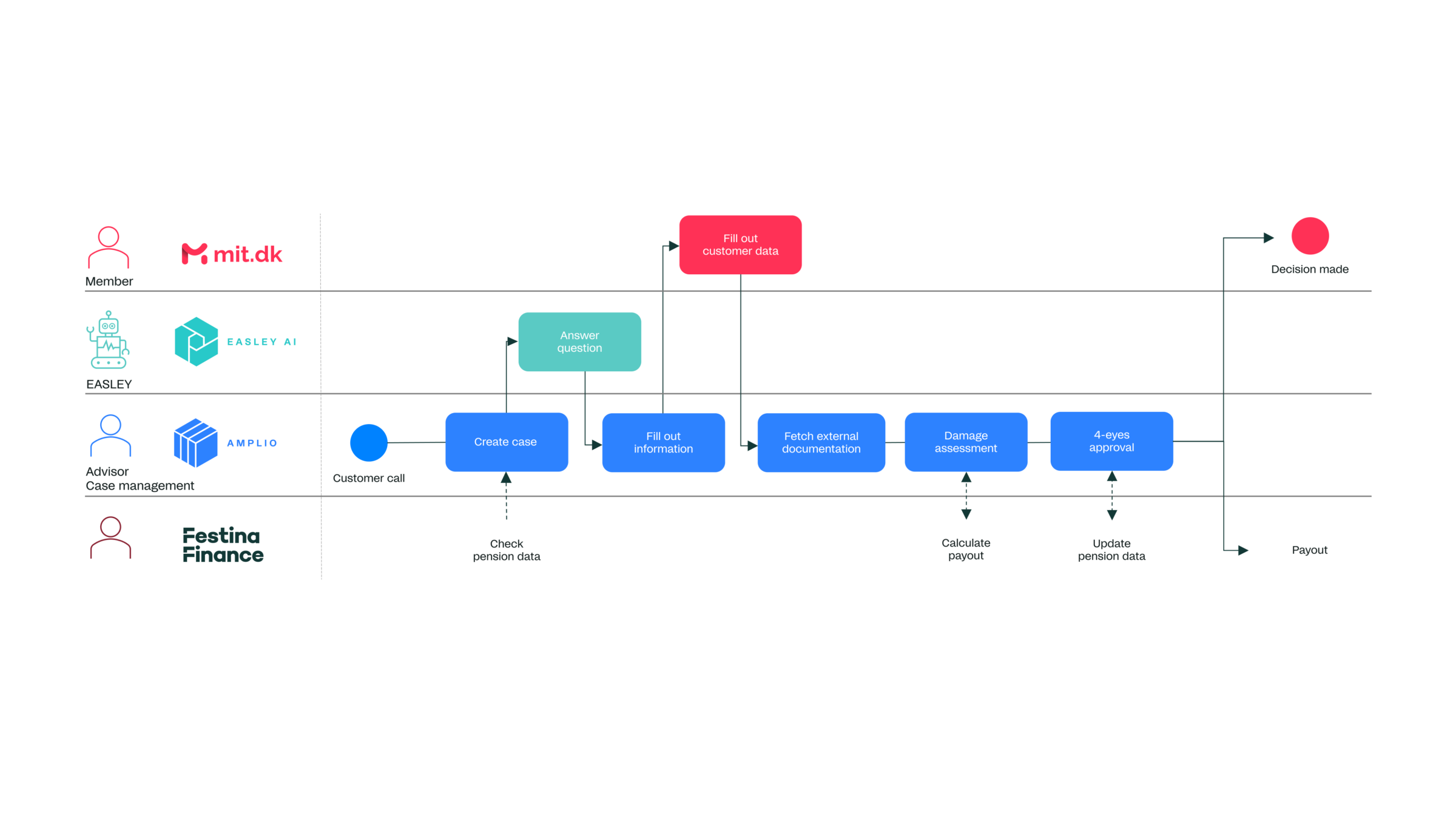

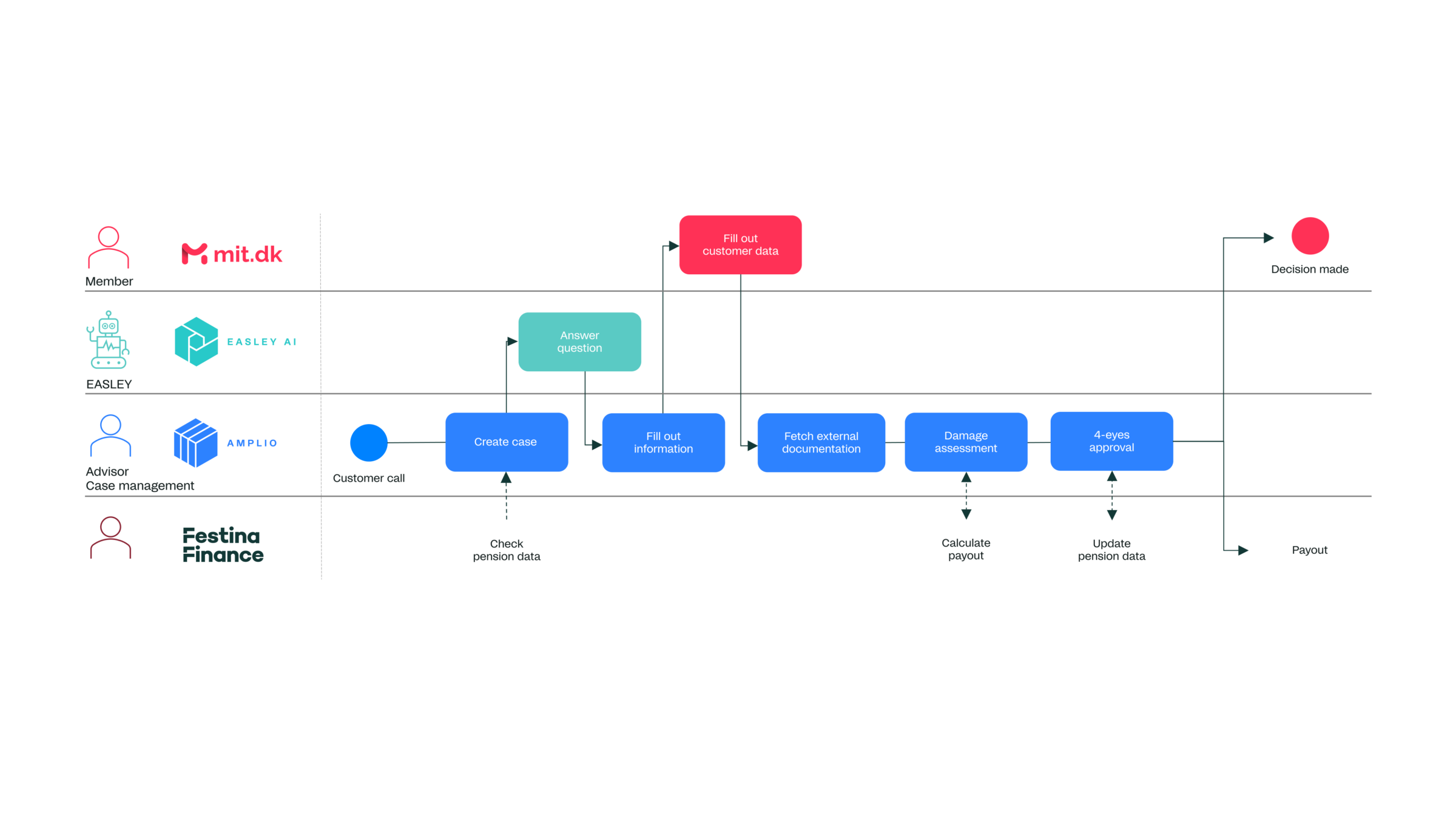

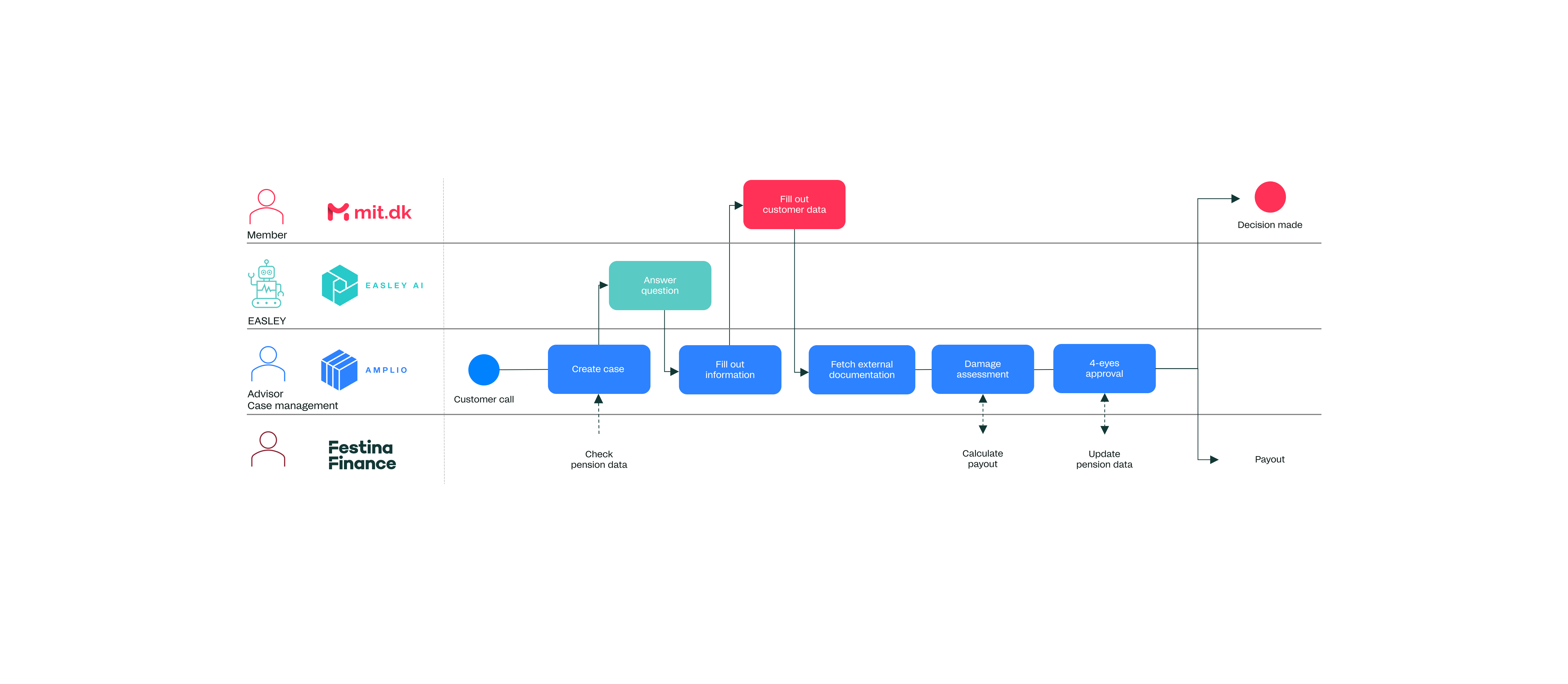

How it all fits together

The following is a simplified workflow for handling a disability claim.

Click here to view the full image on mobile.

Want to learn more?